Welcome!

Insurance Data Logic (“IDL”) was established by senior insurance executives with underwriting, brokerage and actuarial experience with its primary objective of providing new sources of underwriting, claims and marketing information in three insurance tech and media areas.

Insurance Data Logic (“IDL”) was established by senior insurance executives with underwriting, brokerage and actuarial experience with its primary objective of providing new sources of underwriting, claims and marketing information in three insurance tech and media areas.

Our content and analytics are changing the way underwriters, brokers and insureds look at information and data. We can help you make the right decision in both evaluating and purchasing insurance. Click slide show on right.

Insurance Premium Estimator

Our online Insurance Premium Estimator allows an agent/broker or insured to view the method an underwriter uses to quote a submission based on evaluation of an application and supporting data. A user obtains a better understanding of the different rating factors assigned to limits, deductibles, territory, business characteristics, claim histiory and various risk parameters associated with an insurance product – all used in coverage determination and premium quotation. The Insurance Premium Estimator can work with Insurance Policy Metrics to estimate premium price and measure coverage. More Info

Our online Insurance Premium Estimator allows an agent/broker or insured to view the method an underwriter uses to quote a submission based on evaluation of an application and supporting data. A user obtains a better understanding of the different rating factors assigned to limits, deductibles, territory, business characteristics, claim histiory and various risk parameters associated with an insurance product – all used in coverage determination and premium quotation. The Insurance Premium Estimator can work with Insurance Policy Metrics to estimate premium price and measure coverage. More Info

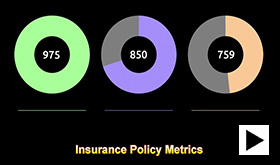

Insurance Policy Metrics

Insurance Policy Metrics (“IPM”) is the first benchmark service to provide a consistent method of comparing both commercial and personal insurance policies quantitatively with a singular numerical factor. The IPM factor assists both insureds and brokers in purchasing insurance and also insurers in reviewing the benefits or negatives of their policy as compared to competition. IPM is being initially developed for cyber insurance and for pet health insurance. Other applications include professional liability, directors and officers liability insurance, builders risk insurance, travel insurance and most other insurance products. IPM is patent pending with the USPTO. More Info

Insurance Policy Metrics (“IPM”) is the first benchmark service to provide a consistent method of comparing both commercial and personal insurance policies quantitatively with a singular numerical factor. The IPM factor assists both insureds and brokers in purchasing insurance and also insurers in reviewing the benefits or negatives of their policy as compared to competition. IPM is being initially developed for cyber insurance and for pet health insurance. Other applications include professional liability, directors and officers liability insurance, builders risk insurance, travel insurance and most other insurance products. IPM is patent pending with the USPTO. More Info

News, Information & Services

For marketing of the IPM program, IDL has developed insurance websites that provide concise news, information and services by insurance product line to readers. Insurance professionals focus by product line. We also produce industry and product specific conferences and webinars. Most industry resources are general and contain information that is extraneous or not of interest to potential users who concentrate their time and effort by insurance specialty.

For marketing of the IPM program, IDL has developed insurance websites that provide concise news, information and services by insurance product line to readers. Insurance professionals focus by product line. We also produce industry and product specific conferences and webinars. Most industry resources are general and contain information that is extraneous or not of interest to potential users who concentrate their time and effort by insurance specialty.

An observation is the immense amount of content available today is not being delivered efficiently in a format useful to the specific product line goals and needs of the underwriter, claims specialist, insurance broker and risk manager. More Info

Learn More – See Several of Our Cyber Insurance Videos

|

|

|

|

|

|

|

|